Financial Spring Cleaning Tips for Less Stress, More Savings

By Marnie Kunz

Financial spring cleaning may sound like it’s not very fun but it’s actually a great way to reduce your stress and simplify your life. April is Financial Literacy Month and tax month, making it the perfect time to spring clean your finances. With some simple steps, you can review and refresh your finances, secure your information, and declutter financial papers and electronic notifications. By tackling your finances with a spring cleaning mindset, you can get organized, identify areas you can save, and clarify your goals to make progress toward achieving them. This article will offer tips to help you do some financial spring cleaning to simplify your finances and save more.

Related: Financial Self-Care Tips

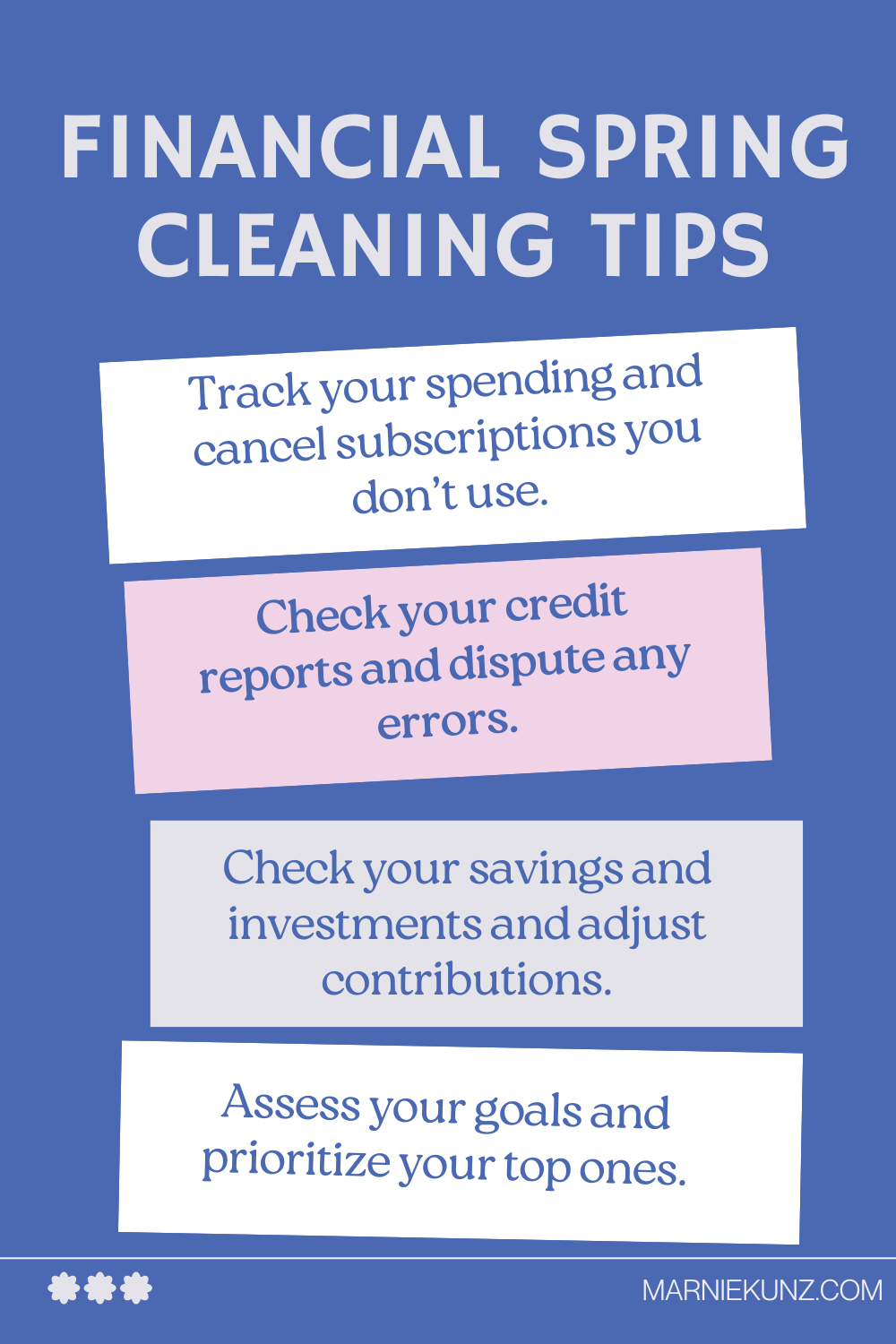

Decluttering Your Spending Habits

I’ll admit budgeting is one of my least favorite financial tasks, but the simple act of tracking your spending can be so insightful. And there are easy ways to track your spending and budget using apps like Rocket Money (my personal favorite). You can sign up for a free account and track and categorize your expenses for a quick and easy reference. Rocket Money will send you stats and allow you to set savings goals, making budgeting easier than ever.

Review Your Budget (or Create One!)

If you prefer to do things on your own, there are many ways to budget, including using spreadsheets or simply writing out your monthly expenses and income. One of the most often overlooked but common expenses is unpredictable ones that arise unexpectedly like taking your dog to the vet or replacing an item of furniture that got destroyed. Be sure to include room for these miscellaneous expenses in your budget.

Action Item: Keep an emergency savings account that you regularly contribute to and it will help prevent you from going into debt when unexpected or emergency expenses arise. A good general rule of thumb is to have 3 months of living expenses (enough to cover all your monthly costs) in an emergency fund. If you’re a freelancer or self-employed, you may want to keep up to 6 months of income in your emergency fund.

Identify and Eliminate Unnecessary Subscriptions

Most of us have subscriptions we don’t use that we have on auto-pay. Look through your bank transactions from the last month and identify any subscription payments you have that you don’t want or need. This may include streaming services, apps you don’t use, and gym memberships. If you’re a small business owner, you will also want to do this with your business account as it’s easy to forget about services or apps we signed up for and don’t actually use for business.

If you haven’t used something in the last month, get rid of it. I have to say since I’m also a certified fitness trainer, don’t axe your gym membership unless you really don’t use it. If you aren’t using your gym for medical reasons like an injury, see if you can pause your membership until you are better.

Action Item: Go through your bank transactions from the last month and cancel any subscriptions that you pay for and don’t use.

Assess Your “Little Leaks”

I’m not from the strict school of “don’t get a latte” if it makes you happy every day and you can afford it. But it is good to be mindful of your spending habits. Once again, looking at your bank transactions is the key to finding out what extra items you buy frequently. If you have a limited budget right now, you may be able to cut out one or two of your extras while you build your savings. Regardless of what you decide, looking at your transactions will be eye-opening as you may be spending more than you realize without thinking about it.

Action Tip: Look at your transactions from the last month and see what extra items keep popping up. Once you’re aware of how you spend your money, you can decide what is really worth it and if you want to cut any excess expenditures.

Tidying Up Your Financial Foundation

Review Your Savings and Investments

It’s easy to forget to check on savings and investments when the chaos of life is going on. But financial spring cleaning is a great time to log into your accounts and check on your progress. Are you on track for your savings goals with an emergency fund and retirement savings? Are your investments still aligned with your risk tolerance and time horizon of when you want to start taking disbursements from your retirement or other accounts? You may need to contribute more to an account or rebalance investment accounts.

Action Tip: Check your savings and investment account balances and contribution rates. Adjust your contribution amounts to suit your long-term goals.

Organize Your Financial Documents

Mail can pile up, and that often includes financial documents. Organize your important financial papers so you have your insurance policies, tax returns, bank statements, credit card and loan statements, and investment statements in separate folders. Creating a digital or physical filing system will help you secure important documents and have them on hand when you need them.

On the other hand, you may have paper copies of financial documents or credit card offers you don’t need. Use a paper shredder to get rid of these documents while protecting your information.

Action Tip: Create a digital or physical filing system for your important financial documents. You can use folders, filing cabinets, or digital folders on your computer to organize your documents. Get rid of financial papers you don’t need by shredding them.

Check Your Credit Report

Financial spring cleaning is a good time to check your credit reports. You can get a free credit report from all three credit bureaus at AnnualCreditReport.com. Review your reports to make sure there are no fraudulent activities or inaccurate information. If you see something that is incorrect, reach out to the credit bureau electronically or by mile to correct the information.

Action Tip: Review your credit reports from all three credit bureaus - Experian, Transunion, and Equifax. Even though your bank or other financial institutions like Credit Karma may offer you an estimated credit score number, it’s important to review your reports from each credit bureau to ensure there is no false information. This can also show you debt amounts and areas of your credit that you can improve if you have something big coming up like purchasing a home or car.

Polishing Your Financial Future

Revisit Your Financial Goals

Assess your financial goals and priorities. Has anything changed in your life or with your goals? You may find that things you wanted last year are not as important to you or one goal has become more important than your other financial goals. Examining your goals will help you set your budget and determine how much money to allocate to savings.

Action Tip: Write down your top financial goals for the next year and the next 5 years. Break down your big, long-term goals into milestones and track your progress so you can achieve them.

Automate Where Possible

For your financial spring cleaning, if you haven’t already, set up automated savings and investment transfers. This will help keep you on track for retirement and other big goals like buying a house or paying for college. You can also set up automated bill payments to reduce your risk of missed payments and late fees.

Action Tip: Identify at least one financial task you can automate and set it up.

Consider a Professional Check-Up

If you need help with managing your finances, consider consulting with a financial counselor or certified financial planner.™ A financial professional can help you set and achieve financial goals such as saving for retirement, investing for the future, or paying down debt.

Financial Spring Cleaning for Peace of Mind

Doing a financial spring cleaning can help you declutter your finances, get organized, and prioritize your most important goals. Whether you want to whittle down your debt, pay for your children’s education, or save for retirement, taking some time to assess and organize your finances will help you achieve your goals. Taking a few small steps now can make a big difference in paving a brighter future.

Marnie Kunz is a writer and personal finance student based in Brooklyn, NY. She is currently a CFP® candidate. When she’s not writing for others, you can find Marnie on her websites, Runstreet and Book of Dog.